Ap Statistics Chapter 8 Interest Rates and Mortgages Again

8 Chapter 8. Regression Basics

Regression assay, like nearly multivariate statistics, allows you to infer that there is a human relationship between two or more variables. These relationships are seldom exact because there is variation caused past many variables, not just the variables being studied.

If yous say that students who report more than brand better grades, yous are really hypothesizing that there is a positive human relationship between one variable, studying, and some other variable, grades. You could then consummate your inference and test your hypothesis by gathering a sample of (amount studied, grades) information from some students and use regression to see if the relationship in the sample is strong enough to safely infer that in that location is a human relationship in the population. Detect that even if students who report more brand better grades, the human relationship in the population would not be perfect; the same amount of studying volition not result in the same grades for every pupil (or for 1 student every time). Some students are taking harder courses, like chemistry or statistics; some are smarter; some report finer; and some get lucky and find that the professor has asked them exactly what they understood best. For each level of amount studied, there will be a distribution of grades. If there is a relationship between studying and grades, the location of that distribution of grades will change in an orderly manner as you lot move from lower to higher levels of studying.

Regression analysis is one of the most used and nigh powerful multivariate statistical techniques for it infers the being and form of a functional relationship in a population. In one case you learn how to use regression, you will exist able to gauge the parameters — the slope and intercept — of the role that links two or more variables. With that estimated function, you will be able to infer or forecast things similar unit costs, interest rates, or sales over a wide range of conditions. Though the simplest regression techniques seem limited in their applications, statisticians have developed a number of variations on regression that greatly expand the usefulness of the technique. In this chapter, the basics will be discussed. Once over again, the t-distribution and F-distribution will be used to examination hypotheses.

What is regression?

Before starting to acquire well-nigh regression, go back to algebra and review what a function is. The definition of a function can exist formal, similar the one in my freshman calculus text: "A part is a set of ordered pairs of numbers (10,y) such that to each value of the first variable (x) at that place corresponds a unique value of the second variable (y)" (Thomas, 1960).[one]. More intuitively, if there is a regular relationship between two variables, at that place is usually a function that describes the relationship. Functions are written in a number of forms. The most general is y = f(x), which just says that the value of y depends on the value of x in some regular fashion, though the form of the relationship is not specified. The simplest functional form is the linear part where:

![]()

α and β are parameters, remaining abiding as x and y change. α is the intercept and β is the slope. If the values ofα and β are known, yous tin find the y that goes with any x by putting the 10 into the equation and solving. There tin can be functions where one variable depends on the values values of two or more other variables wherex1 andxtwo together decide the value of y. There can too be non-linear functions, where the value of the dependent variable ( y in all of the examples we have used then far) depends on the values of one or more other variables, but the values of the other variables are squared, or taken to some other ability or root or multiplied together, before the value of the dependent variable is determined. Regression allows you to approximate straight the parameters in linear functions just, though there are tricks that let many not-linear functional forms to exist estimated indirectly. Regression besides allows you to test to see if at that place is a functional relationship between the variables, by testing the hypothesis that each of the slopes has a value of zero.

First, let us consider the simple example of a two-variable function. You believe that y, the dependent variable, is a linear function of x, the contained variable — y depends on x. Collect a sample of (x, y) pairs, and plot them on a set of x, y axes. The bones idea behind regression is to detect the equation of the straight line that comes as close as possible to as many of the points as possible. The parameters of the line fatigued through the sample are unbiased estimators of the parameters of the line that would come as close as possible to as many of the points every bit possible in the population, if the population had been gathered and plotted. In keeping with the convention of using Greek messages for population values and Roman letters for sample values, the line drawn through a population is:

![]()

while the line fatigued through a sample is:

y = a + bx

In nearly cases, fifty-fifty if the whole population had been gathered, the regression line would not go through every indicate. Almost of the phenomena that business researchers deal with are not perfectly deterministic, so no part will perfectly predict or explain every ascertainment.

Imagine that yous wanted to study the estimated price for a one-sleeping accommodation apartment in Nelson, BC. Y'all decide to estimate the price every bit a function of its location in relation to downtown. If yous collected 12 sample pairs, you lot would find different apartments located within the same distance from downtown. In other words, yous might draw a distribution of prices for apartments located at the same distance from downtown or away from downtown. When you use regression to estimate the parameters of cost = f(distance), you are estimating the parameters of the line that connects the mean price at each location. Considering the all-time that tin can be expected is to predict the hateful price for a certain location, researchers ofttimes write their regression models with an extra term, the error term, which notes that many of the members of the population of (location, cost of apartment) pairs will not have exactly the predicted price because many of the points do not lie directly on the regression line. The error term is usually denoted as ε , or epsilon, and you lot oftentimes run across regression equations written:

![]()

Strictly, the distribution of ε at each location must be normal, and the distributions of ε for all the locations must have the aforementioned variance (this is known as homoscedasticity to statisticians).

Simple regression and to the lowest degree squares method

In estimating the unknown parameters of the population for the regression line, we need to employ a method by which the vertical distances betwixt the nonethelesshoped-for estimated regression line and the observed values in our sample are minimized. This minimized distance is chosen sample fault, though it is more than commonly referred to as residual and denoted by e.In more mathematical form, the difference between the y and its predicted valueis the residual in each pair of observations for ten and y. Apparently, some of these residuals volition exist positive (above the estimated line) and others volition be negative (beneath the line). If nosotros add all these residuals over the sample size and enhance them to the ability two in club to foreclose the chance those positive and negative signs are cancelling each other out, we tin can write the following benchmark for our minimization problem:

![]()

S is the sum of squares of the residuals. By minimizing South over any given set of observations for x and y, we volition get the following useful formula:

[latex]b=\frac{\sum{(x-\bar{x})(y-\bar{y})}}{\sum{(x-\bar{10})^ii}}[/latex]

Afterwards computing the value of b from the above formula out of our sample information, and the means of the 2 series of information on xand y, 1 tin can but recover the intercept of the estimated line using the following equation:

![]()

For the sample data, and given the estimated intercept and slope, for each observation nosotros tin define a rest as:

![]()

Depending on the estimated values for intercept and slope, we can draw the estimated line along with all sample data in a y–ten panel. Such graphs are known every bit scatter diagrams. Consider our analysis of the price of one-chamber apartments in Nelson, BC. Nosotros would collect data for y=price of 1 bedchamber flat, x1 =its associated altitude from downtown, and 102 =the size of the apartment, every bit shown in Table 8.ane.

| y = price of apartments in $1000 x1 = altitude of each flat from downtown in kilometres ten2 = size of the apartment in foursquare feet | ||

| y | x1 | ten2 |

| 55 | one.five | 350 |

| 51 | 3 | 450 |

| 60 | 1.75 | 300 |

| 75 | 1 | 450 |

| 55.five | three.1 | 385 |

| 49 | i.6 | 210 |

| 65 | 2.3 | 380 |

| 61.5 | two | 600 |

| 55 | four | 450 |

| 45 | 5 | 325 |

| 75 | 0.65 | 424 |

| 65 | two | 285 |

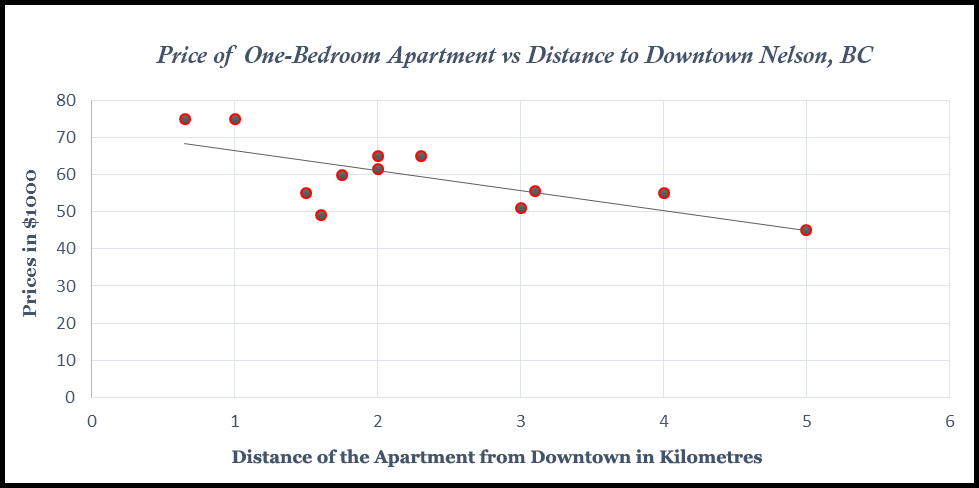

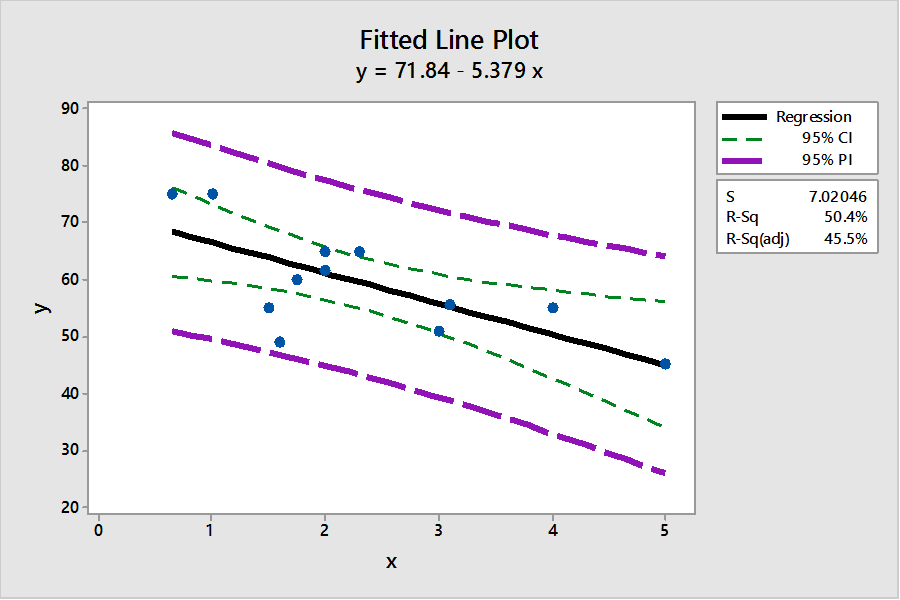

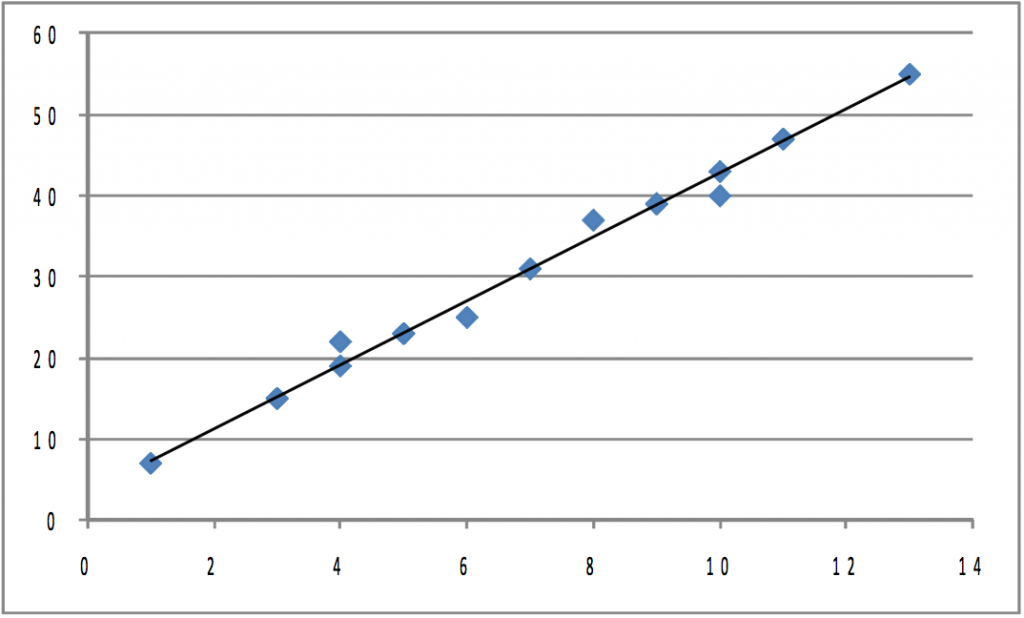

The graph (shown in Figure 8.1) is a scatter plot of the prices of the apartments and their distances from downtown, along with a proposed regression line.

In gild to plot such a scatter diagram, you lot can utilise many available statistical software packages including Excel, SAS, and Minitab. In this scatter diagram, a negative simple regression line has been shown. The estimated equation for this scatter diagram from Excel is:

![]()

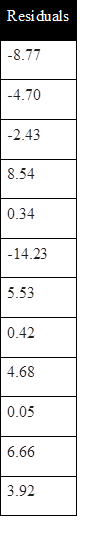

Where a=71.84 andb=-5.38. In other words, for every additional kilometre from downtown an flat is located, the toll of the flat is estimated to be $5380 cheaper, i.e. 5.38*$m=$5380. One might also exist curious about the fitted values out of this estimated model. Yous tin simply plug the actual value for x into the estimated line, and find the fitted values for the prices of the apartments. The residuals for all 12 observations are shown in Figure viii.ii.

You should also notice that by minimizing errors, you have not eliminated them; rather, this method of least squares but guarantees the best fitted estimated regression line out of the sample data.

In the presence of the remaining errors, one should be aware of the fact that in that location are still other factors that might not have been included in our regression model and are responsible for the fluctuations in the remaining errors. By calculation these excluded but relevant factors to the model, nosotros probably expect the remaining error will show less meaningful fluctuations. In determining the cost of these apartments, the missing factors may include age of the apartment, size, etc. Because this type of regression model does not include many relevant factors and assumes only a linear relationship, information technology is known as a uncomplicated linear regression model.

Testing your regression: does y really depend on ten?

Understanding that there is a distribution of y (apartment cost) values at each x (distance) is the fundamental for understanding how regression results from a sample can be used to test the hypothesis that there is (or is not) a relationship betwixt x and y. When you hypothesize that y = f(ten), you hypothesize that the slope of the line (β in y = α + βx + ε) is not equal to zero. If β was equal to zero, changes in ten would not crusade any change in y. Choosing a sample of apartments, and finding each apartment's distance to downtown, gives you a sample of (x, y). Finding the equation of the line that best fits the sample will give you a sample intercept, α, and a sample gradient, β. These sample statistics are unbiased estimators of the population intercept, α, and slope, β. If another sample of the aforementioned size is taken, some other sample equation could be generated. If many samples are taken, a sampling distribution of sample β'due south, the slopes of the sample lines, will be generated. Statisticians know that this sampling distribution of b'southward will be normal with a mean equal to β, the population slope. Because the standard deviation of this sampling distribution is seldom known, statisticians adult a method to judge it from a unmarried sample. With this estimated due southb , a t-statistic for each sample tin can be computed:

![]()

where northward = sample size

m = number of explanatory (10) variables

b = sample slope

β= population slope

sb = estimated standard difference of b'south, oftentimes called the standard error

These t'southward follow the t-distribution in the tables with n–chiliad-one df.

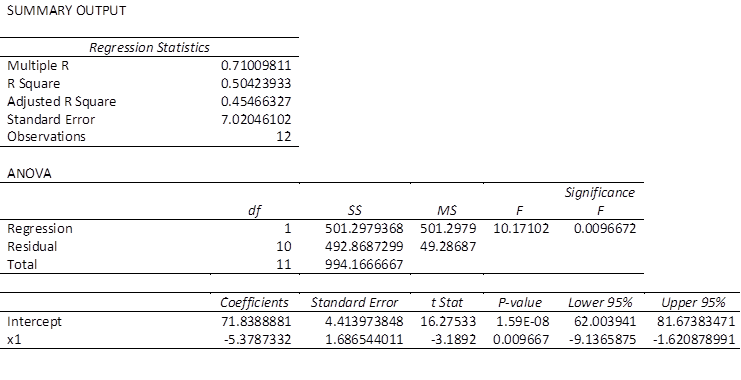

Computing sb is tedious, and is most e'er left to a calculator, specially when at that place is more one explanatory variable. The judge is based on how much the sample points vary from the regression line. If the points in the sample are not very close to the sample regression line, it seems reasonable that the population points are also widely scattered around the population regression line and different samples could easily produce lines with quite varied slopes. Though there are other factors involved, in general when the points in the sample are farther from the regression line, sb is greater. Rather than learn how to compute sb , it is more useful for you to learn how to find information technology on the regression results that you get from statistical software. It is often called the standard error and there is one for each contained variable. The printout in Figure 8.3 is typical.

Y'all will need these standard errors in order to test to see if y depends on ten or not. You want to test to run into if the slope of the line in the population, β, is equal to aught or not. If the slope equals zero, and then changes in x do non outcome in any alter in y. Formally, for each independent variable, you volition take a examination of the hypotheses:

[latex]H_o: \beta = 0[/latex]

[latex]H_a: \beta \neq 0[/latex]

If the t-score is large (either negative or positive), then the sample b is far from zero (the hypothesized β), and Ha should be accepted. Substitute zippo for b into the t-score equation, and if the t-score is minor, b is close enough to zip to accept Ha . To find out what t-value separates "close to zero" from "far from cypher", cull an alpha, detect the degrees of freedom, and utilize a t-table from any textbook, or simply use the interactive Excel template from Chapter iii, which is shown once again in Figure 8.4.

Figure eight.four Interactive Excel Template for Determining t-Value from the t-Tabular array – run into Appendix 8.

Remember to halve blastoff when conducting a ii-tail examination like this. The degrees of freedom equal n – chiliad -i, where northward is the size of the sample and yard is the number of independent ten variables. There is a separate hypothesis test for each independent variable. This means you test to see if y is a part of each x separately. You tin can too test to see if β > 0 (or β < 0) rather than β ≠ 0 past using a ane-tail exam, or test to see if β equals a particular value by substituting that value for β when computing the sample t-score.

Testing your regression: does this equation really assist predict?

To examination to run across if the regression equation really helps, see how much of the mistake that would exist fabricated using the mean of all of the y'south to predict is eliminated past using the regression equation to predict. By testing to see if the regression helps predict, you are testing to see if in that location is a functional relationship in the population.

Imagine that you take establish the mean toll of the apartments in our sample, and for each apartment, y'all accept made the simple prediction that cost of flat volition be equal to the sample mean, y . This is non a very sophisticated prediction technique, merely recall that the sample mean is an unbiased estimator of population mean, so on average you will be right. For each apartment, yous could compute your error past finding the departure betwixt your prediction (the sample mean, y ) and the bodily cost of an apartment.

As an alternative mode to predict the price, you lot tin can take a reckoner notice the intercept, α, and gradient, β, of the sample regression line. Now, you lot can make another prediction of how much each apartment in the sample may exist worth by computing:

[latex]\hat{y} = \alpha + \beta(altitude)[/latex]

Again, yous can detect the error fabricated for each apartment past finding the departure betwixt the price of apartments predicted using the regression equation ŷ, and the observed cost, y . Finally, find how much using the regression improves your prediction past finding the deviation betwixt the price predicted using the mean, y , and the price predicted using regression, ŷ. Observe that the measures of these differences could be positive or negative numbers, but that error or improvement implies a positive distance.

Coefficient of Conclusion

If you utilize the sample mean to predict the corporeality of the price of each apartment, your mistake is (y– y ) for each flat. Squaring each mistake so that worries most signs are overcome, then adding the squared errors together, gives you a measure of the total mistake you lot make if yous want to predict y. Your total mistake is Σ(y– y )2. The total mistake you make using the regression model would be Σ(y-ŷ)ii. The difference between the mistakes, a raw measure out of how much your prediction has improved, is Σ(ŷ– y )2. To make this raw mensurate of the improvement meaningful, you need to compare information technology to one of the 2 measures of the full mistake. This means that at that place are two measures of "how good" your regression equation is. One compares the improvement to the mistakes withal made with regression. The other compares the comeback to the mistakes that would exist made if the mean was used to predict. The first is called an F-score considering the sampling distribution of these measures follows the F-distribution seen in Chapter 6, "F-test and Ane-Way ANOVA". The 2d is called Rtwo , or the coefficient of determination.

All of these mistakes and improvements have names, and talking about them volition be easier once y'all know those names. The total mistake made using the sample mean to predict, Σ(y– y )2, is chosen the sum of squares, total. The total error fabricated using the regression, Σ(y-ŷ)2, is called the sum of squares, error (residual). The general improvement made by using regression, Σ(ŷ– y )2 is chosen the sum of squares, regression or sum of squares, model. You should exist able to encounter that:

sum of squares, total = sum of squares, regression + sum of squares, error (residual)

[latex]\sum{(y-\bar{y})^two} = \sum{(ŷ-\bar{y})^2} + \sum{(y-ŷ)^2}[/latex]

In other words, the full variations in y can exist partitioned into 2 sources: the explained variations and the unexplained variations. Further, we can rewrite the above equation as:

![]()

where SST stands for sum of squares due to total variations, SSR measures the sum of squares due to the estimated regression model that is explained by variable x, and SSE measures all the variations due to other factors excluded from the estimated model.

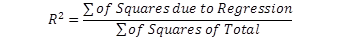

Going back to the idea of goodness of fit, 1 should be able to hands summate the percentage of each variation with respect to the full variations. In particular, the strength of the estimated regression model can now exist measured. Since we are interested in the explained office of the variations past the estimated model, nosotros simply divide both sides of the above equation by SST, and we get:

![]()

Nosotros then isolate this equation for the explained proportion, besides known every bit R-square:

![]()

Only in cases where an intercept is included in a uncomplicated regression model will the value of R2 exist bounded between zip and 1. The closer Rii is to one, the stronger the model is. Alternatively, Rii is also found past:

This is the ratio of the improvement fabricated using the regression to the mistakes made using the mean. The numerator is the comeback regression makes over using the mean to predict; the denominator is the mistakes (errors) made using the mean. Thus R2 just shows what proportion of the mistakes fabricated using the mean are eliminated by using regression.

In the case of the market for one-bedroom apartments in Nelson, BC, the percent of the variations in price for the apartments is estimated to be effectually 50%. This indicates that only half of the fluctuations in apartment prices with respect to the average price tin can exist explained by the apartments' distance from downtown. The other 50% are not controlled (that is, they are unexplained) and are subject to further inquiry. 1 typical approach is to add together more than relevant factors to the elementary regression model. In this instance, the estimated model is referred to as a multiple regression model.

While R2 is non used to test hypotheses, it has a more intuitive pregnant than the F-score. The F-score is the mensurate ordinarily used in a hypothesis test to see if the regression made a pregnant comeback over using the mean. It is used because the sampling distribution of F-scores that it follows is printed in the tables at the back of nearly statistics books, then that information technology can be used for hypothesis testing. It works no matter how many explanatory variables are used. More formally, consider a population of multivariate observations, (y, x1, xtwo, …, 10m ), where in that location is no linear relationship betwixt y and the x's, and then that y ≠ f(y, x1, ten2, …, xm ). If samples of n observations are taken, a regression equation estimated for each sample, and a statistic, F, institute for each sample regression, then those F'southward will be distributed like those shown in Figure eight.5, the F-table with (grand, n–m-i) df.

Effigy 8.5 Interactive Excel Template of an F-Tabular array – see Appendix 8.

The value of F can be calculated as:

wheren is the size of the sample, andm is the number of explanatory variables (how many x's in that location are in the regression equation).

If Σ(ŷ– y )2 the sum of squares regression (the comeback), is large relative to Σ(ŷ– y )iii, the sum of squares residual (the mistakes however fabricated), and so the F-score will exist big. In a population where at that place is no functional relationship between y and the 10'due south, the regression line will have a slope of zero (information technology volition be flat), and the ŷ will be close to y. As a result very few samples from such populations volition accept a large sum of squares regression and large F-scores. Because this F-score is distributed like the one in the F-tables, the tables can tell you whether the F-score a sample regression equation produces is large enough to exist judged unlikely to occur if y ≠ f(y, x1, xii, …, tenm ). The sum of squares regression is divided past the number of explanatory variables to account for the fact that it always decreases when more variables are added. Y'all tin too await at this every bit finding the improvement per explanatory variable. The sum of squares balance is divided past a number very close to the number of observations because it e'er increases if more than observations are added. You can also look at this every bit the guess mistake per observation.

[latex]H_0: y \neq f(y,x_1,x_2,\cdots,x_m)[/latex]

To test to see if a regression equation was worth estimating, test to see if in that location seems to exist a functional relationship:

[latex]H_a: y = f(y,x_1,x_2,\cdots,x_m)[/latex]

This might look similar a 2-tailed test since Ho has an equal sign. Only, past looking at the equation for the F-score you should be able to run across that the data support Ha simply if the F-score is large. This is because the data support the existence of a functional relationship if the sum of squares regression is large relative to the sum of squares residual. Since F-tables are usually one-tail tables, cull an α, go to the F-tables for that α and (m, n–m-1) df, and notice the table F. If the computed F is greater than the table F, and then the computed F is unlikely to have occurred if Ho is true, and you can safely determine that the data support Ha . There is a functional relationship in the population.

Now that you take learned all the necessary steps in estimating a elementary regression model, y'all may take some time to re-estimate the Nelson flat model or whatsoever other elementary regression model, using the interactive Excel template shown in Figure 8.half dozen. Like all other interactive templates in this textbook, yous tin change the values in the xanthous cells only. The event volition be shown automatically within this template. For this template, you can only estimate simple regression models with 30 observations. You use special paste/values when you lot paste your information from other spreadsheets. The kickoff step is to enter your information under independent and dependent variables. Side by side, select your alpha level. Check your results in terms of both individual and overall significance. Once the model has passed all these requirements, y'all can select an appropriate value for the independent variable, which in this case is the distance to downtown, to estimate both the conviction intervals for the average price of such an apartment, and the prediction intervals for the selected altitude. Both these intervals are discussed after in this chapter. Retrieve that by changing any of the values in the yellow areas in this template, all calculations will be updated, including the tests of significance and the values for both confidence and prediction intervals.

Figure eight.vi Interactive Excel Template for Simple Regression – run across Appendix 8.

Multiple Regression Analysis

When we add more than explanatory variables to our unproblematic regression model to strengthen its ability to explain existent-world data, we in fact convert a uncomplicated regression model into a multiple regression model. The least squares approach we used in the example of simple regression can still exist used for multiple regression analysis.

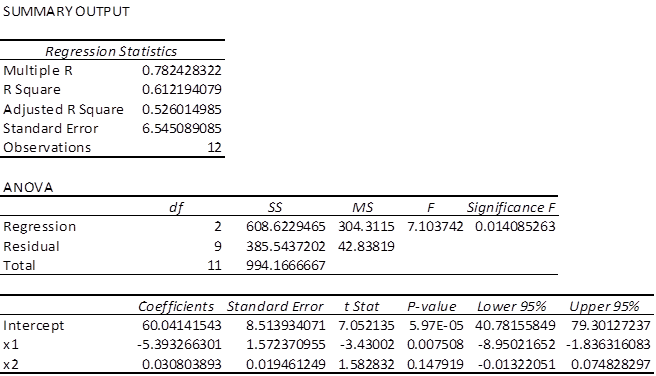

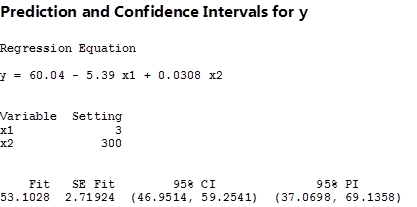

As per our give-and-take in the simple regression model section, our low estimated R2 indicated that only 50% of the variations in the price of apartments in Nelson, BC, was explained by their distance from downtown. Apparently, at that place should be more relevant factors that can be added into this model to make it stronger. Permit'south add the second explanatory cistron to this model. We nerveless data for the area of each flat in square feet (i.e.,x2 ). If we get back to Excel and guess our model including the new added variable, we will see the printout shown in Figure 8.7.

The estimates equation of the regression model is:

predicted price of apartments= sixty.041 – 5.393*distance + .03*area

This is the equation for a airplane, the iii-dimensional equivalent of a straight line. It is still a linear function because neither of the x's nor y is raised to a power nor taken to some root nor are the x'south multiplied together. You can have fifty-fifty more than contained variables, and as long as the function is linear, you lot can guess the slope, β, for each independent variable.

Before using this estimated model for prediction and decision-making purposes, we should examination three hypotheses. First, we can use the F-score to test to see if the regression model improves our ability to predict toll of apartments. In other words, we exam the overall significance of the estimated model. 2d and 3rd, we can utilize the t-scores to test to run across if the slopes of altitude and area are different from zero. These 2 t-tests are also known equally individual tests of significance.

To bear the first exam, nosotros choose an α = .05. The F-score is the regression or model mean square over the balance or error mean square, so the df for the F-statistic are beginning the df for the regression model and, second, the df for the error. There are 2 and 9 df for the F-exam. Co-ordinate to this F-table, with 2 and ix df, the disquisitional F-score for α = .05 is four.26.

The hypotheses are:

H0 : cost ≠ f(altitude, area)

Ha : price = f(altitude, surface area)

Because the F-score from the regression, 6.812, is greater than the disquisitional F-score, 4.26, nosotros decide that the data support Ho and conclude that the model helps us predict cost of apartments. Alternatively, nosotros say in that location is such a functional relationship in the population.

Now, we move to the individual examination of significance. We can test to come across if price depends on distance and area. There are (n-m-ane)=(12-2-i)=9 df. There are two sets of hypotheses, i set for β1 , the slope for distance, and one gear up for βii , the gradient for area. For a small town, one may look that β1 , the slope for distance, will be negative, and expect that β2 will be positive. Therefore, we will use a ane-tail exam on β1 , as well every bit for βii :

[latex]H_a: \beta _1 <0 \qquad H_a:\beta _2<0[/latex] Since we have two one-tail tests, the t-values we choose from the t-tabular array will be the aforementioned for the two tests. Using <em>α = .05 and 9 df, we choose .05/2=.025 for the t-score for β1 with a ane-tail test, and come up with two.262. Looking back at our Excel printout and checking the t-scores, nosotros decide that distance does affect price of apartments, but area is not a pregnant cistron in explaining the toll of apartments. Notice that the printout as well gives a t-score for the intercept, so we could exam to see if the intercept equals zippo or not.

Alternatively, one may become ahead and compare directly the p-values out of the Excel printout against the assumed level of significance (i.eastward., α = .05). We tin easily see that thep-values associated with the intercept and price are both less than blastoff, and equally a consequence we reject the hypothesis that the associated coefficients are zero (i.e., both are significant). However, area is not a significant cistron since its associatedp-value is greater than alpha.

While at that place are other required assumptions and conditions in both simple and multiple regression models (we encourage students to consult an intermediate business statistics open textbook for more detailed discussions), here nosotros only focus on 2 relevant points almost the use and applications of multiple regression.

The first point is related to the interpretation of the estimated coefficients in a multiple regression model. You should be careful to notation that in a simple regression model, the estimated coefficient of our independent variable is simply the slope of the line and can exist interpreted. It refers to the response of the dependent variable to a one-unit change in the contained variable. However, this interpretation in a multiple regression model should exist adjusted slightly. The estimated coefficients under multiple regression assay are the response of the dependent variable to a one-unit change in one of the independent variables when the levels of all other independent variables are kept constant. In our instance, the estimated coefficient of price of an apartment in Nelson, BC, indicates that — for a given size of flat— information technology will drop by 5.248*1000=$5248 for every one kilometre that the flat is away from downtown.

The second point is about the employ of R2 in multiple regression analysis. Technically, adding more than independent variables to the model volition increase the value of Rtwo , regardless of whether the added variables are relevant or irrelevant in explaining the variation in the dependent variable. In order to adjust the inflated Rtwo due to the irrelevant variables added to the model, the following formula is recommended in the instance of multiple regression:

![]()

where n is the sample size, and yard is number of the estimated parameters in our model.

Back to our before Excel results for the multiple regression model estimated for the apartment example, we tin see that while the Rii has been inflated from .504 to .612 due to the new added gene, apartment size, the adapted Rtwo has dropped the inflated value to .526. To empathize it ameliorate, y'all should pay attending to the associated p-value for the newly added factor. Since this value is more than .05, we cannot reject the hypothesis that the true coefficient of apartment size (surface area) is significantly different from zero. In other words, in its current state of affairs, apartment size is not a significant cistron, yet the value of R2 has been inflated!

Furthermore, the adjusted R2 indicates that only 61.2% of variations in price of ane-chamber apartments in Nelson, BC, can be explained by their locations and sizes. Almost 40% of the variations of the price still cannot exist explained by these two factors. One may seek to improve this model, by searching for more relevant factors such as manner of the apartment, year built, etc. and add them in to this model.

Using the interactive Excel template shown in Figure eight.8, you can approximate a multiple regression model. Again, enter your information into the yellow cells only. For this template you are allowed to apply upward to 50 observations for each cavalcade. Like all other interactive templates in this textbook, yous use special paste/values when you paste your data from other spreadsheets. Specifically, if y'all have fewer than 50 data entries, you must as well fill out the rest of the empty yellowish cells under X1, X2, and Y with zeros. At present, select your alpha level. By clicking enter, you will non only accept all your estimated coefficients along with their t-values, etc., you will also be guided equally to whether the model is pregnant both overall and individually. If your p-value associated with F-value within the ANOVA table is not less than the selected alpha level, you will encounter a bulletin indicating that your estimated model is not overall significant, and as a effect, no values for C.I. and P.I. will be shown. Past either changing the blastoff level and/or adding more than authentic data, it is possible to gauge a more meaning multiple regression model.

Effigy eight.eight Interactive Excel Template for Multiple Regression Model - meet Appendix eight.

One more point is about the format of your assumed multiple regression model. You can see that the nature of the associations between the dependent variable and all the independent variables may not e'er be linear. In reality, you lot will confront cases where such relationships may be better formed by a nonlinear model. Without going into the details of such a non-linear model, just to give you an idea, you should be able to transform your selected information for X1, X2, and Y before estimating your model. For instance, one possible multiple regression non-linear model may be a model in which both the dependent and independent variables have been transformed to a natural logarithm rather than a level. In order to gauge such a model within Effigy 8.5, all you need to do is transform the data in all three columns in a split sheet from level to logarithm. In doing this, simply utilize =log(say A1) where in cell A1 you have the get-go observation of X1, and =log(say B1),.... Finally, just cut and special paste/value into the yellowish columns within the template. Now y'all have estimated a multiple regression model with both sides in a non-linear form (i.e., log form).

Predictions using the estimated uncomplicated regression

If the estimated regression line fits well into the information, the model can then be used for predictions. Using the above estimated simple regression model, nosotros can predict the toll of an apartment a given distance to downtown. This is known equally the prediction interval or P.I. Alternatively, we may predict the hateful toll of the apartment, also known as the confidence interval or C.I., for the mean value.

In predicting intervals for the cost of an apartment that is six kilometres away from downtown, we simply set ten=half-dozen , and substitute it back into the estimated equation:

[latex]y=71.84-5.38\times half dozen = \$39.56[/latex]

Y'all should pay attention to the scale of information. In this example, the dependent variable is measured in $1000s. Therefore, the predicted value for an apartment six kilometres from downtown is 39.56*1000=$39,560. This value is known as theindicate estimate of the prediction and is non reliable, equally we are not clear how close this value is to the truthful value of the population.

A more than reliable estimate can exist synthetic by setting up an interval effectually the signal judge. This can exist washed in two means. Nosotros can predict the particular value of y for a given value of x ,or we can estimate the expected value (hateful) of y,for a given value of x. For the particular value of y, we use the following formula for the interval:

![]()

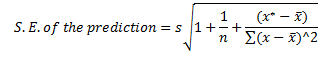

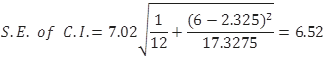

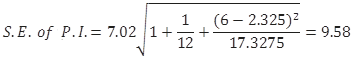

where the standard error, S.E., of the prediction is calculated based on the following formula:

In this equation, x* is the particular value of the independent variable, which in our instance is vi, andsis the standard error of the regression, calculated equally:

From the Excel printout for the simple regression model, this standard error is estimated every bit 7.02.

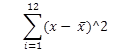

The sum of squares of the independent variable,

tin also be calculated as shown in Figure eight.9.

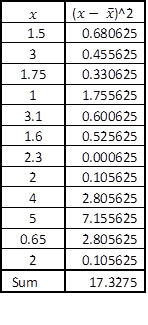

All these calculated values tin can be substituted back into the formula for the S.East. of the prediction:

At present that the S.E. of the confidence interval has been calculated, you can pick up the cut-off bespeak from the t-table. Given the degrees of freedom 12-2=10, the appropriate value from the t-table is 2.23. You utilize this data to calculate the margin of error as vi.52*2.23=14.54. Finally, construct the prediction interval for the item value of the price of an apartment located vi kilometres away from downtown every bit:

![]()

This is a compact version of the prediction interval. For a more general version of any confidence interval for whatsoever given conviction level of blastoff, we can write:

![]()

Intuitively, for say a .05 level of confidence, we are 95% confident that the true parameter of the population will be within these two lower and upper limits:

![]()

Based on our unproblematic regression model that only includes distance every bit a pregnant factor in predicting the toll of an apartment, and for a particular apartment six kilometres away from downtown, we are 95% confident that the true price of an apartments in Nelson, BC, is between $25,037 and $54,096, with a width of $29,059. One should not be surprised there is such a broad width, given the fact that the coefficient of determination of this model was only 50%, and the fact that we have selected a distance far away from the hateful altitude from downtown. We can always ameliorate these numbers by adding more explanatory variables to our simple regression model. Alternatively, we tin can predict only for the numbers as much equally possible shut to the downtown expanse.

Now we guess the expected value (mean) of y for a given value of ten, the and so-called prediction interval. The process of constructing intervals is very like to the previous example, except we use a new formula for S.E. and of course we set up the intervals for the mean value of the apartment cost (i.east., =59.33).

You should be very careful to note the difference between this formula and the ane introduced earlier for Southward.Due east. for predicting the item value of y for a given value of x.They look very like simply this formula comes with an extra 1 inside the radical!

The margin of fault is then calculated as 2.179*3.82=eight.32. We use this to set up straight the lower and upper limits of the estimates:

![]()

Thus, for theaverage price of apartments located in Nelson, BC, six kilometres abroad from downtown, nosotros are 95% confident that this boilerplate cost will be betwixt $18,200 and $60,920, with a width of $47,720. Compared with the before width for C.I., information technology is obvious that we are less confident in predicting the average toll. The reason is that the S.Due east. for the prediction is always larger than the Due south.E. for the confidence interval.

This process can be repeated for all unlike levels ofx, to calculate the associated confidence and prediction intervals. By doing this, nosotros will have a range of lower and upper levels for both P.I.s and C.I.s. All these numbers can be reproduced within the interactive Excel template shown in Effigy viii.8. If you use a statistical software such as Minitab, yous will directly plot a besprinkle diagram with all P.I.due south and C.I.s as well equally the estimated linear regression line all in one diagram. Effigy eight.ten shows such a diagram from Minitab for our example.

Effigy viii.10 indicates that a more than reliable prediction should be made as close equally possible to the mean of our observations forx. In this graph, the widths of both intervals are at the everyman levels closer to the means of x and y.

Yous should exist careful to annotation that Figure 8.10 provides the predicted intervals but for the example of a simple regression model. For the multiple regression model, you may use other statistical software packages, such every bit SAS, SPSS, etc., to estimate both P.I. and C.I. For instance, by selecting ten1 =3, and ten2 =300, and coding these figures into Minitab, you lot volition see the results every bit shown in Figure 8.xi. Alternatively, you may use the interactive Excel template provided in Figure 8.8 to judge your multiple regression model, and to cheque for the significance of the estimated parameters. This template can also exist used to construct both the P.I. and C.I. for the given values of xane =3, and x2 =300 or whatever other values of your selection. Furthermore, this template enables y'all to exam if the estimated multiple regression model is overall significant. When the estimated multiple regression model is not overall significant, this template will non provide the P.I. and C.I. To practice this instance, you may want to alter the yellow columns of x1 and ten2 with different random numbers that are not correlated with the dependent variable. Once the estimated model is not overall pregnant, no prediction values volition be provided.

The 95% C.I., and P.I. figures in the brackets are the lower and upper limits of the intervals given the specific values for distance and size of apartments. The fitted value of the price of apartment, as well as the standard mistake of this value, are also estimated.

We have simply given you some rough ideas about how the basic regression calculations are washed. We left out other steps needed to calculate more detailed results of regression without a figurer on purpose, for you volition never compute a regression without a computer (or a high-end calculator) in all of your working years. However, by working with these interactive templates, you will have a much better risk to play around with any data to see how the outcomes can be contradistinct, and to detect their implications for the real-world business conclusion-making process.

Correlation and covariance

The correlation between two variables is important in statistics, and it is ordinarily reported. What is correlation? The meaning of correlation can be discovered past looking closely at the give-and-take—information technology is nigh co-relation, and that is what information technology means: how two variables are co-related. Correlation is also closely related to regression. The covariance between 2 variables is also important in statistics, but it is seldom reported. Its pregnant can also exist discovered by looking closely at the discussion—it is co-variance, how ii variables vary together. Covariance plays a behind-the-scenes role in multivariate statistics. Though you will not see covariance reported very often, agreement it will help you sympathize multivariate statistics like agreement variance helps you empathise univariate statistics.

There are two ways to look at correlation. The starting time flows directly from regression and the 2nd from covariance. Since y'all only learned about regression, it makes sense to start with that approach.

Correlation is measured with a number betwixt -1 and +1 chosen the correlation coefficient. The population correlation coefficient is unremarkably written as the Greek rho, ρ, and the sample correlation coefficient as r. If you lot have a linear regression equation with only one explanatory variable, the sign of the correlation coefficient shows whether the slope of the regression line is positive or negative, while the absolute value of the coefficient shows how close to the regression line the points lie. If ρ is +.95, then the regression line has a positive slope and the points in the population are very close to the regression line. If r is -.thirteen and then the regression line has a negative slope and the points in the sample are scattered far from the regression line. If y'all square r, you volition get R2 , which is higher if the points in the sample lie very close to the regression line and then that the sum of squares regression is close to the sum of squares total.

The other arroyo to explaining correlation requires understanding covariance, how two variables vary together. Because covariance is a multivariate statistic, it measures something well-nigh a sample or population of observations where each observation has two or more variables. Retrieve of a population of (10,y) pairs. First notice the hateful of the x's and the mean of the y'due south, μx and μy . And then for each observation, observe (x - μx )(y - μy ). If the ten and the y in this ascertainment are both far to a higher place their means, then this number will exist large and positive. If both are far below their ways, information technology will also exist large and positive. If you found Σ(x - μx )(y - μy ), it would be large and positive if 10 and y move up and down together, so that large x's go with large y'due south, small x'due south go with pocket-sized y'south, and medium x'south get with medium y's. However, if some of the large x's go with medium y's, etc. then the sum will be smaller, though probably yet positive. A Σ(x - μx )(y - μy ) implies that 10's above μten are more often than not paired with y's above μy , and those x's beneath their hateful are generally paired with y's below their mean. As yous can see, the sum is a measure of how x and y vary together. The more frequently like x's are paired with similar y's, the more 10 and y vary together and the larger the sum and the covariance. The term for a single observation, (x - μx )(y - μy ), will be negative when the 10 and y are on opposite sides of their means. If large 10'south are usually paired with small y's, and vice versa, most of the terms will exist negative and the sum volition be negative. If the largest x'south are paired with the smallest y's and the smallest x'due south with the largest y's, then many of the (10 - μx )(y - μy ) will be large and negative and so will the sum. A population with more than members will have a larger sum simply because there are more terms to be added together, so yous divide the sum by the number of observations to get the terminal measure out, the covariance, or cov:

![]()

The maximum for the covariance is the product of the standard deviations of the 10 values and the y values, σx σy . While proving that the maximum is exactly equal to the production of the standard deviations is complicated, you lot should be able to encounter that the more spread out the points are, the greater the covariance can be. By now you lot should sympathize that a larger standard deviation means that the points are more than spread out, so you should understand that a larger σten or a larger σy will allow for a greater covariance.

Sample covariance is measured similarly, except the sum is divided by n-1 so that sample covariance is an unbiased estimator of population covariance:

[latex]sample \ cov= \frac{\sum{(x-\bar{x})(y-\bar{y})}}{(n-one)}[/latex]

Correlation simply compares the covariance to the standard deviations of the two variables. Using the formula for population correlation:

or

At its maximum, the accented value of the covariance equals the product of the standard deviations, so at its maximum, the absolute value of r will exist 1. Since the covariance tin can be negative or positive while standard deviations are ever positive, r tin be either negative or positive. Putting these ii facts together, you can see that r will be between -i and +one. The sign depends on the sign of the covariance and the accented value depends on how close the covariance is to its maximum. The covariance rises every bit the relationship betwixt x and y grows stronger, then a strong relationship between 10 and y will result in r having a value close to -one or +1.

Covariance, correlation, and regression

Now it is time to remember about how all of this fits together and to see how the two approaches to correlation are related. Start by assuming that y'all take a population of (x, y) which covers a wide range of y-values, but merely a narrow range of x-values. This means that σy is large while σten is pocket-sized. Assume that yous graph the (ten, y) points and find that they all lie in a narrow band stretched linearly from lesser left to meridian right, so that the largest y'south are paired with the largest ten'due south and the smallest y's with the smallest x'south. This means both that the covariance is big and a practiced regression line that comes very close to almost all the points is easily drawn. The correlation coefficient will also be very high (close to +1). An example volition evidence why all these happen together.

Imagine that the equation for the regression line is y=3+4ten, μy = 31, and μx = vii, and the 2 points farthest to the top correct, (10, 43) and (12, 51), prevarication exactly on the regression line. These two points together contribute ∑(ten-μten )(y-μy ) =(10-vii)(43-31)+(12-vii)(51-31)= 136 to the numerator of the covariance. If we switched the x'south and y's of these two points, moving them off the regression line, so that they became (10, 51) and (12, 43), μx , μy , σten , and σy would remain the same, but these points would simply contribute (10-seven)(51-31)+(12-7)(43-31)= 120 to the numerator. As y'all can see, covariance is at its greatest, given the distributions of the x'due south and y's, when the (x, y) points lie on a straight line. Given that correlation, r, equals 1 when the covariance is maximized, you can encounter that r=+1 when the points lie exactly on a straight line (with a positive slope). The closer the points lie to a directly line, the closer the covariance is to its maximum, and the greater the correlation.

As the instance in Effigy eight.12 shows, the closer the points lie to a directly line, the college the correlation. Regression finds the directly line that comes as close to the points as possible, so it should non exist surprising that correlation and regression are related. One of the ways the goodness of fit of a regression line can be measured is past R2 . For the simple two-variable instance, R2 is simply the correlation coefficientr, squared.

Correlation does not tell us anything near how steep or flat the regression line is, though it does tell us if the slope is positive or negative. If we took the initial population shown in Figure 8.12, and stretched it both left and correct horizontally so that each bespeak'due south 10-value changed, but its y-value stayed the same, σ10 would grow while σy stayed the aforementioned. If you pulled every bit to the right and to the left, both μx and μy would stay the same. The covariance would certainly grow since the (x-μx ) that goes with each indicate would be larger absolutely while the (y-μy )'s would stay the same. The equation of the regression line would change, with the gradient b condign smaller, but the correlation coefficient would exist the same because the points would be simply equally close to the regression line as earlier. Once once again, notice that correlation tells you lot how well the line fits the points, but it does non tell you anything about the slope other than if it is positive or negative. If the points are stretched out horizontally, the gradient changes only correlation does not. Likewise find that though the covariance increases, correlation does non because σx increases, causing the denominator in the equation for finding r to increase equally much as covariance, the numerator.

The regression line and covariance approaches to understanding correlation are patently related. If the points in the population lie very close to the regression line, the covariance volition exist large in absolute value since the 10'due south that are far from their mean will exist paired with y'due south that are far from theirs. A positive regression slope means that ten and y rise and fall together, which also ways that the covariance will be positive. A negative regression slope means that x and y move in opposite directions, which ways a negative covariance.

Summary

Simple linear regression allows researchers to gauge the parameters — the intercept and slopes — of linear equations connecting 2 or more than variables. Knowing that a dependent variable is functionally related to one or more than independent or explanatory variables, and having an gauge of the parameters of that function, greatly improves the power of a researcher to predict the values the dependent variable will accept under many conditions. Being able to estimate the consequence that one independent variable has on the value of the dependent variable in isolation from changes in other independent variables tin be a powerful aid in determination-making and policy design. Being able to test the existence of private effects of a number of independent variables helps decision-makers, researchers, and policy-makers identify what variables are well-nigh important. Regression is a very powerful statistical tool in many ways.

The idea behind regression is simple: it is just the equation of the line that comes equally close equally possible to equally many of the points as possible. The mathematics of regression are not so simple, however. Instead of trying to larn the math, most researchers use computers to find regression equations, and so this chapter stressed reading calculator printouts rather than the mathematics of regression.

Two other topics, which are related to each other and to regression, were as well covered: correlation and covariance.

Something as powerful every bit linear regression must have limitations and bug. At that place is a whole subject, econometrics, which deals with identifying and overcoming the limitations and problems of regression.

morenofouldlairity.blogspot.com

Source: https://pressbooks.nscc.ca/introductorybusinessstatistics/chapter/regression-basics-2/

0 Response to "Ap Statistics Chapter 8 Interest Rates and Mortgages Again"

Post a Comment